stop on quote vs stop limit on quote etrade

Limit orders are executed automatically as soon as there is an opportunity to trade at the limit price or better. A stop price and a limit price.

Potentially Protect A Stock Position Against A Market Drop Learn More

Remember that the key difference between a limit order and a stop order is that the limit order will only be filled at the specified limit price or better.

. With a stop limit order traders are guaranteed that if they receive an execution it will. A stop-limit-on-quote order is an order that an investor. Stop loss orders ensure your trade is executed at the current market price meaning slippage may occur.

This frees the investor from monitoring prices and allows the investor to lock in profits. A buy stop order executes at a stop price that is above the current market price. Join Kevin Horner to learn how each works.

I literally just placed a Stop Limit on Quote with a Stop Trigger of 26099 with a Limit Price of 26099 which your post says isnt working. Stop limit orders are slightly more complicated. Use stop loss orders if you want to ensure your trade is executed no matter the price.

Say you own XYZ right now at 100share but youre afraid itll go down. What the stop-limit-on-quote order does is enable an investor to execute a trade at a specified price or better after the stock price has reached the investors desired stop price. The stop price and the limit price for a stop-limit order do not have to be the same price.

Sell stop orders may exacerbate price declines during times of extreme volatility. For example if John intends to buy ABC Limited stocks that are valued at 50 and are expected to go. A buy Stop Quote Limit order is placed at a stop price above the current market price and will trigger if the national best offer quote is at or higher than the specified stop price.

When the stop price is triggered the limit order is sent to the exchange. When you enter a stop limit on quote order you are placing an order that will turn into a limit order when the stock reaches the stop price. A sell stop quote limit order is placed at a stop price below the current market price and will trigger if the national best bid quote is at or lower than the specified stop price.

Stop limit orders ensure theres no slippage from your set price but your trade wont be executed if the price is unavailable due to low. For example if you place a stop limit on quote sell order with the stop price at 1009 and the limit price set at 1000 then your shares would sell at 1009 or above but not below the stop limit price of 1000. Account holders will set two prices with a stop limit order.

A stop-limit order consists of two prices. Such an order would become an active limit order if market prices reach 300 however the order can only be executed at a price of 250 or better. In contrast a sell stop order executes at a stop price below the current market price.

With a stop-on-quote order a trade will only be initiated once the price reaches a specified level or trigger called a stop price. The trade will only execute at the set price or better. Bad thing about SLOQ is if.

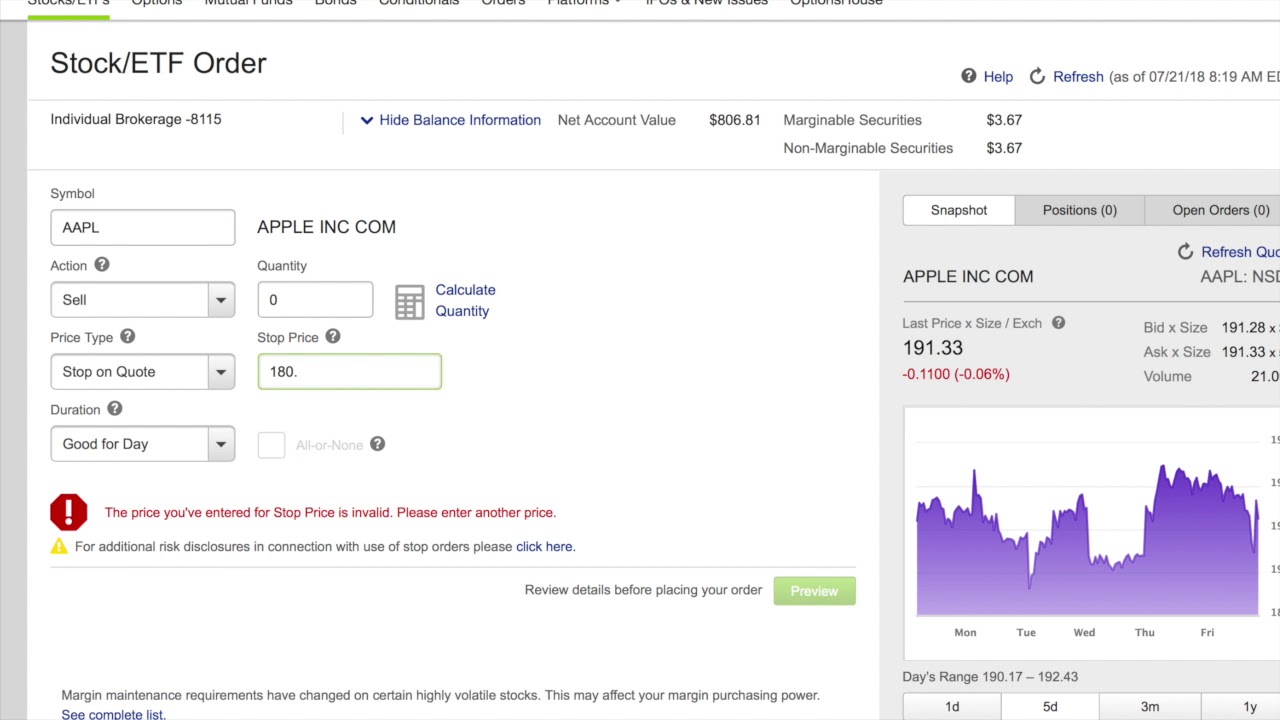

This order type can activate a limit order to buy or sell a security when a specific stop price has been met. Lower than the specified stop price. Select Stop-Limit under the drop-down menu for the Price Type Then enter the Limit Price and Stop Price you wish to pay when executing the trade.

For example a sell stop limit order with a stop price of 300 may have a limit price of 250. It is possible placing a limit price on a stop order may. Lets consider a trader who bought FB for 155 and it is now trading at 185.

When it comes to managing risk stop orders and stop-limit orders are both useful tools but they arent the same. The stop price and the limit price. A limit order will then be working at or better than the limit price you entered.

A stop order on the other hand is used to limit losses. The Limit Price is the limit of what you are willing to buy or sell the shares for when executing the trade. Stop Loss on Quote is sell the stock to the BID price when the stock price reaches the set price.

To protect a portion of their gains 15 the trader places a sell order to stop at 170. The stop price is a price that is above the market price of the stock whereas the limit price is the highest price that a trader is willing to pay per share. A buy stop quote limit order is placed at a stop price above the.

Slava Loza Forex Trader Analyst. Whenever the bid price sell orders or ask price buy orders reaches or surpasses the stop price the stop-on-quote order becomes a market order. Generally a Stop on Quote is called a stop loss or stop order a stop limit on quote is called a stop limit and a trailing stop is well.

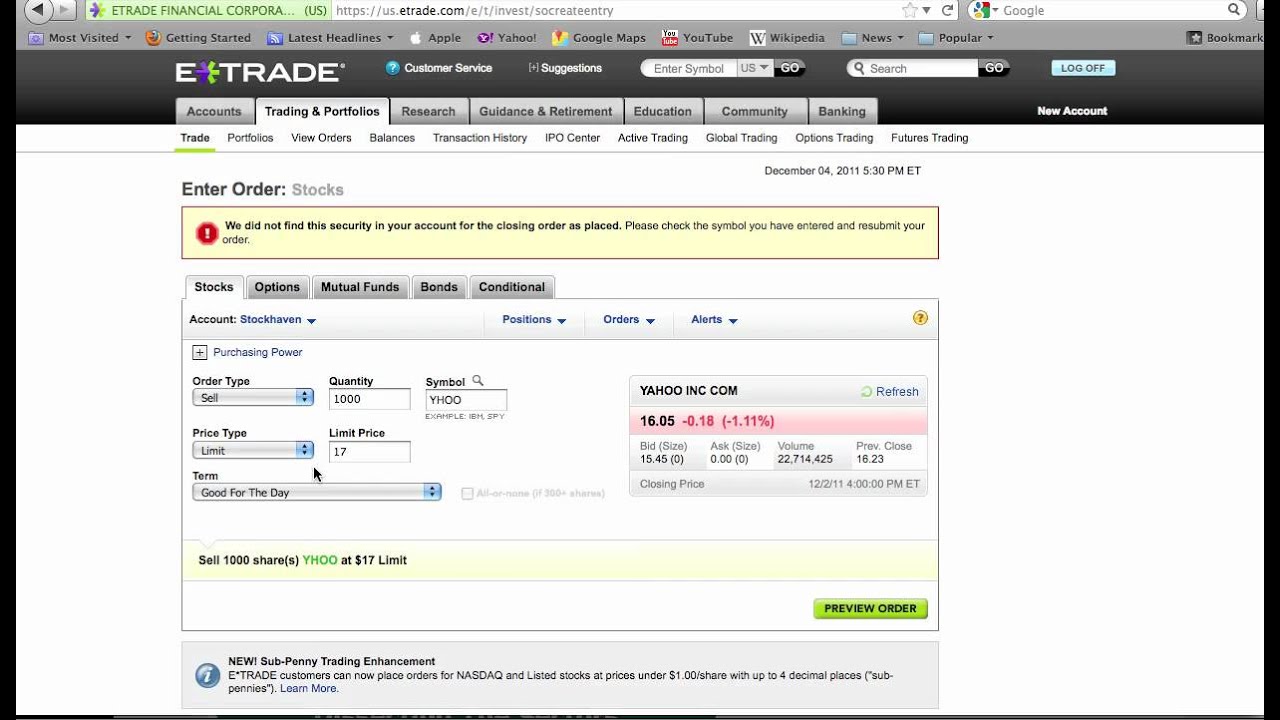

So provide a screenshot or give steps to reproduce or something. Stop orders may be triggered by a short-lived dramatic price change. Stop Loss Limit Etrade changed the stop loss function some time ago.

What the stop-limit-on-quote order does is enable an investor to execute a trade at a specified price or better after the stock price has reached the investors desired stop price. Stop prices are not guaranteed execution prices. Once triggered a Stop Quote Limit order becomes a limit order buy or sell as applicable at a specified limit price and execution may not occur as the market price can.

Whereas once a stop order triggers at the specified price it will be filled at the prevailing price in the marketwhich means that it could be executed at a price significantly different than the stop price. Explain further what youre trying to do. Designed to initiate a sale or purchase when a securities price hits a certain point.

A stop quote limit order combines the features of a stop quote order and a limit order. The Stop Price is the price at which the trade becomes a market order.

What Are Price Types And How To Execute Them With Etrade 3min Youtube

Protecting Yourself With Stops Youtube

How To Use A Stop Loss Order When Trading Etrade Pro Youtube

Stop On Quote Vs Stop Limit On Quote Orders Money Rook

Courses To Learn Share Market Trading Hidden Trailing Stop Etrade

Potentially Protect A Stock Position Against A Market Drop Learn More

E Trade Limit And Stop Loss Orders On Stocks 2022

E Trade 2020 Review Exposing The True Drawbacks For A Pro Trader